Chart pattern cheat sheets can be a useful tool for investors or traders who are interested in trading. They offer a convenient reference guide to the most common chart patterns in financial markets. One can use patterns to analyze potential trends, reversals, and trading opportunities.

Investors and traders in today’s fast-paced financial markets must make decisions quickly, typically with limited information. Cheat sheets for chart patterns enable traders to recognize and interpret them with greater ease. They facilitate better decision-making and give quick access to information that is often locked behind research performed by technical analysts.

In this article, I will take a look at some chart pattern cheat sheets, explain how to use them, and see how viable they are for crypto trading.

Key Takeaways: Chart Patterns Cheat Sheet

- Chart pattern cheat sheets are concise guides that can help traders to quickly identify and interpret common chart patterns, making it easier to open and close positions.

- Cheat sheets offer a visual reference, enabling traders to recognize patterns without having to rely on their memory and thus make informed decisions in a faster and more reliable way.

- Common crypto and stock chart patterns include formations like head and shoulders, double tops, and triangles.

What Is a Chart Pattern?

A chart pattern is a recognizable formation of price movements on a financial chart. Past market data and current price action of an asset, such as cryptocurrency, can help detect potential trends, reversals, and trading opportunities.

Chart patterns are a useful tool for traders. While they can be misleading on some occasions, they are generally effective at understanding and predicting future price movements. For example, if you identify a bearish pattern like the rising wedge pattern, you will know there is a likelihood that price levels will go down.

What Is a Chart Patterns Cheat Sheet?

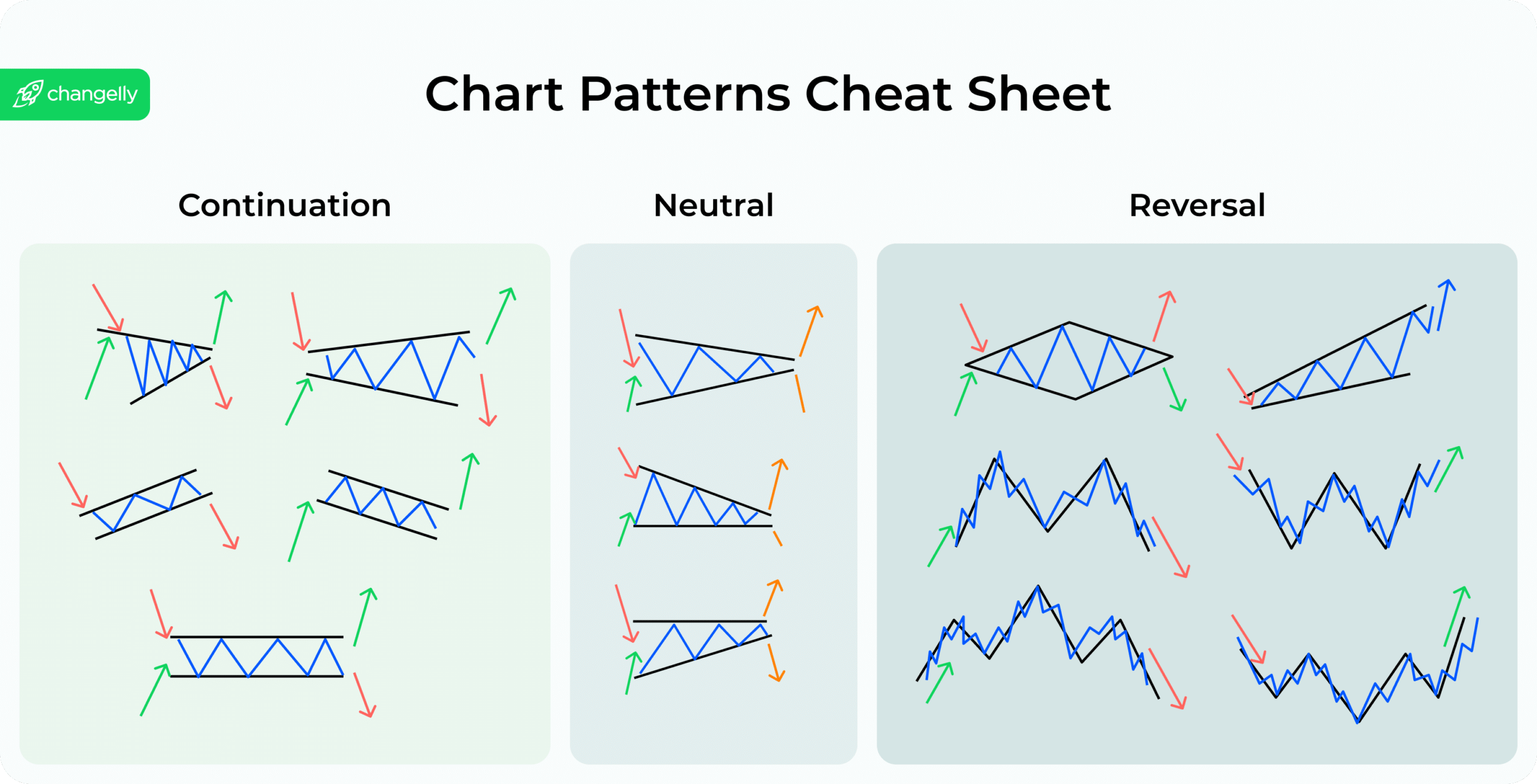

A chart pattern cheat sheet is a useful tool for trading and technical analysis that sums up various chart patterns. It typically includes the names of the patterns, a visual representation of what they look like, and, sometimes, a brief description of their characteristics and what they can potentially lead to.

Cheat sheets can come in different formats, including but not limited to:

- Printed or digital PDFs. These documents can be printed or downloaded for use as a reference guide. Being easily accessible on computers or mobile devices, printable crypto and forex trading patterns cheat sheet PDF files make a convenient tool for traders who need a physical copy at hand.

- Trading platforms. Some trading platforms offer integrated cheat sheets that allow traders to quickly access information on charting patterns without leaving the platform.

- Mobile apps. Some mobile apps also provide built-in cheat sheets as part of their features. This can be useful for traders who want to access chart pattern information on the go.

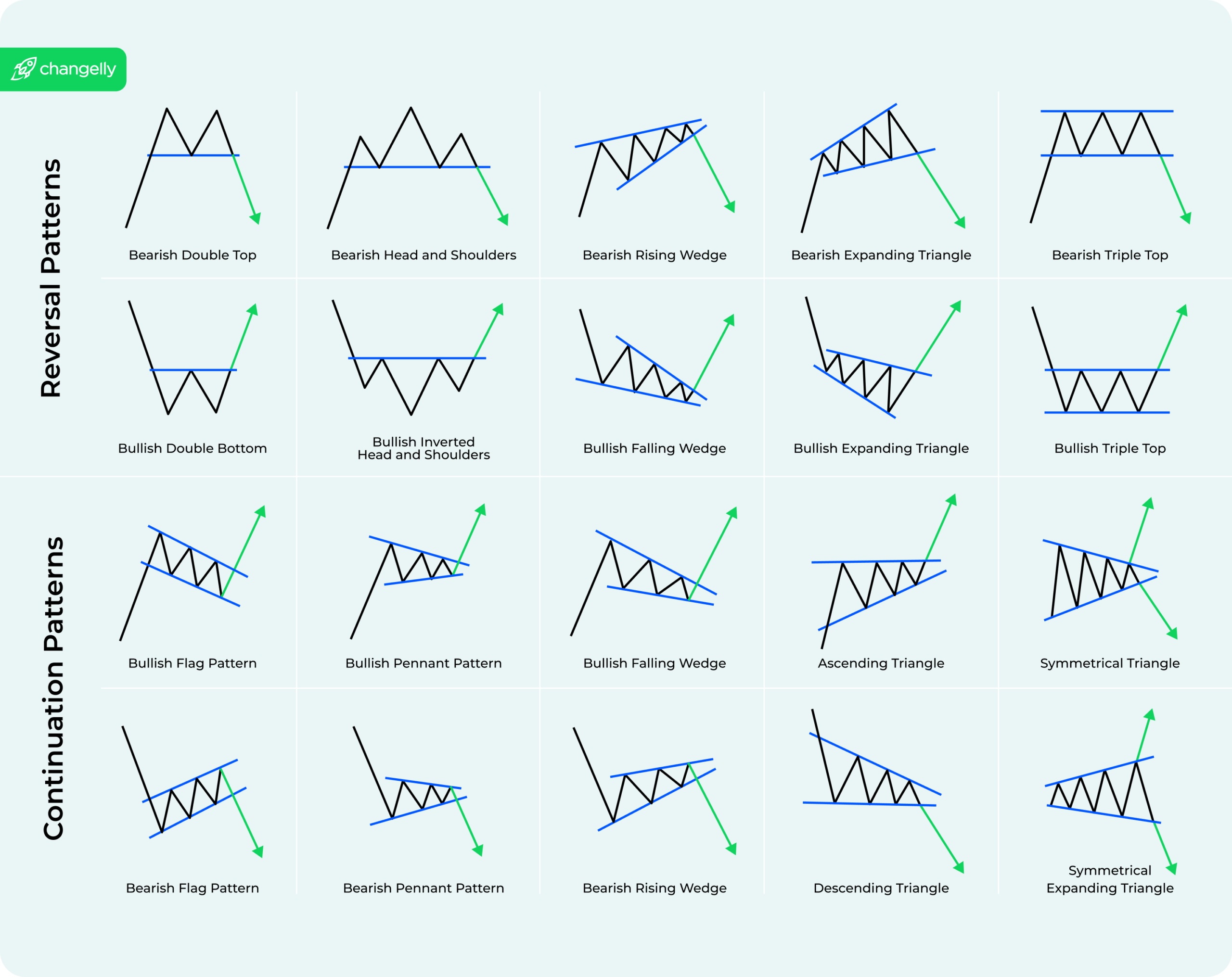

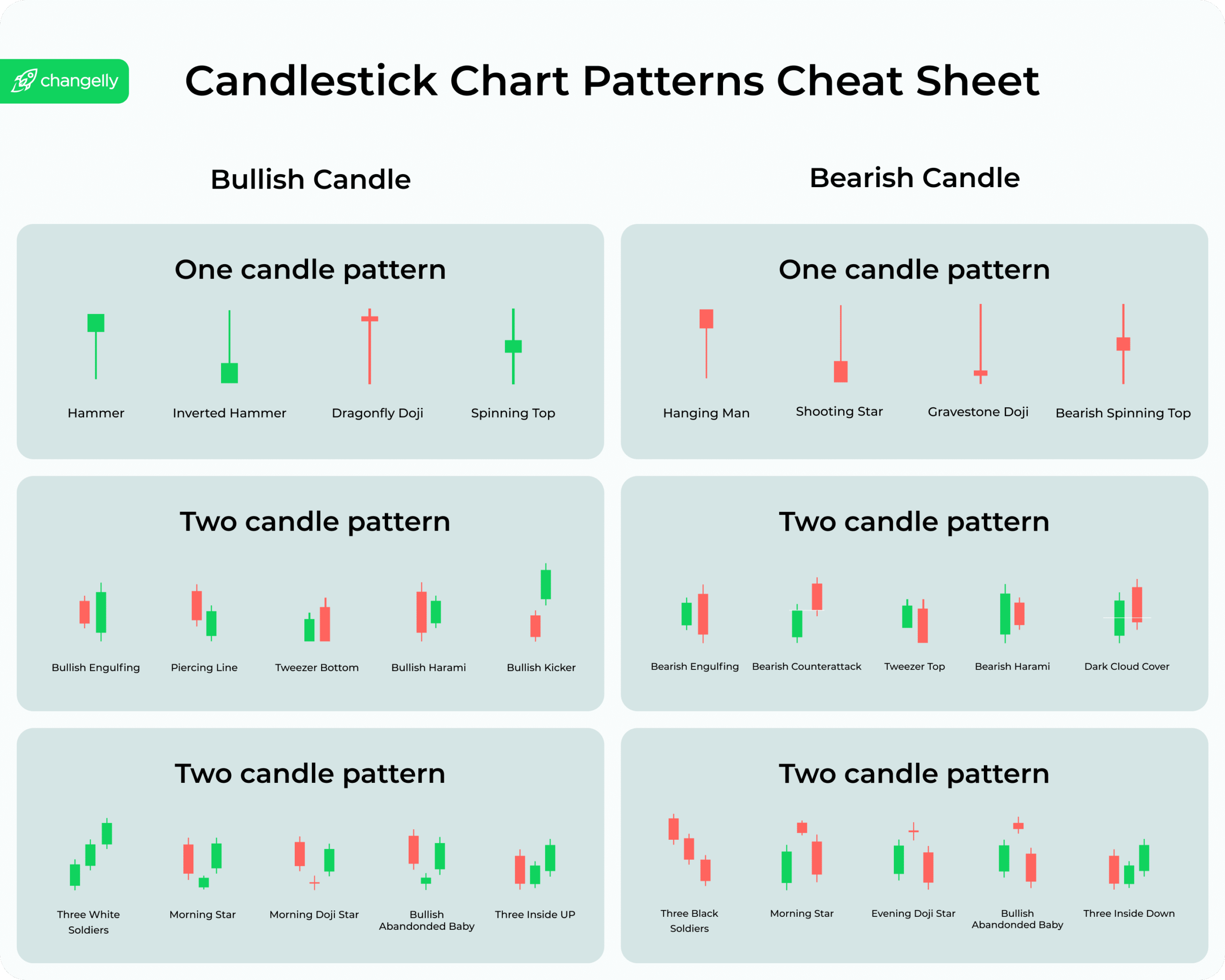

Here is an example of a chart patterns cheat sheet.

3 Major Chart Pattern Types

There are three main types of chart patterns: reversal, continuation, and bilateral. Here is an overview of each of these types and some examples.

Bilateral

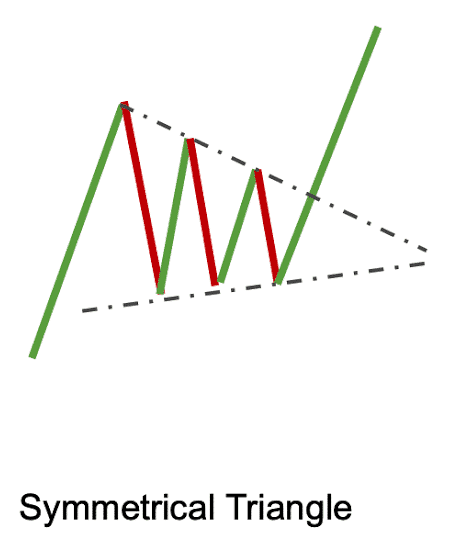

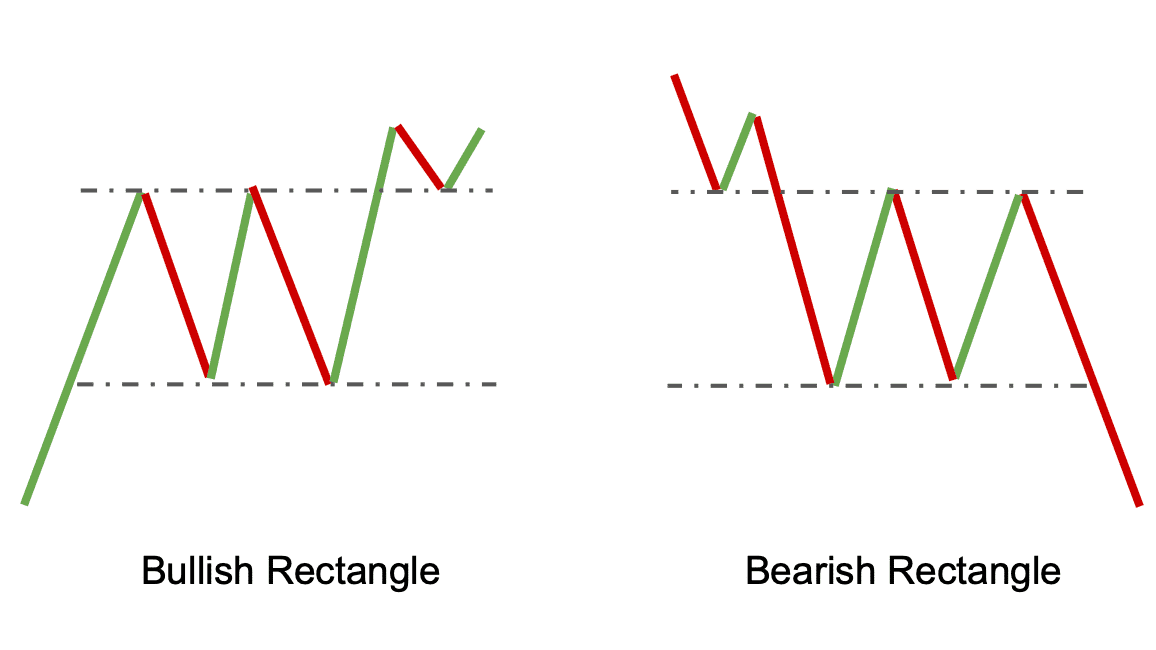

The market exhibits a bilateral pattern when buyers and sellers are unable to gain an advantage. The pattern that develops can result in either the continuation or the reversal of the current trend. Examples of bilateral patterns include:

- Symmetrical Triangle. This bilateral chart pattern is identified when the price is moving in a range, forming a triangle shape with successive lower highs and higher lows. This neutral chart pattern has no particular direction bias and can potentially result in either a bullish or a bearish breakout.

- Rectangle. This pattern emerges when the price fluctuates within two horizontal boundaries. The top line serves as resistance, while the bottom line serves as support. This pattern has the potential to result in either a bullish or a bearish breakout.

Continuation

A continuation chart pattern can indicate that there will be a period of stagnation before the price regains its previous momentum. It is expected that the preceding trend will remain even after the pattern is finished.

Here are some examples:

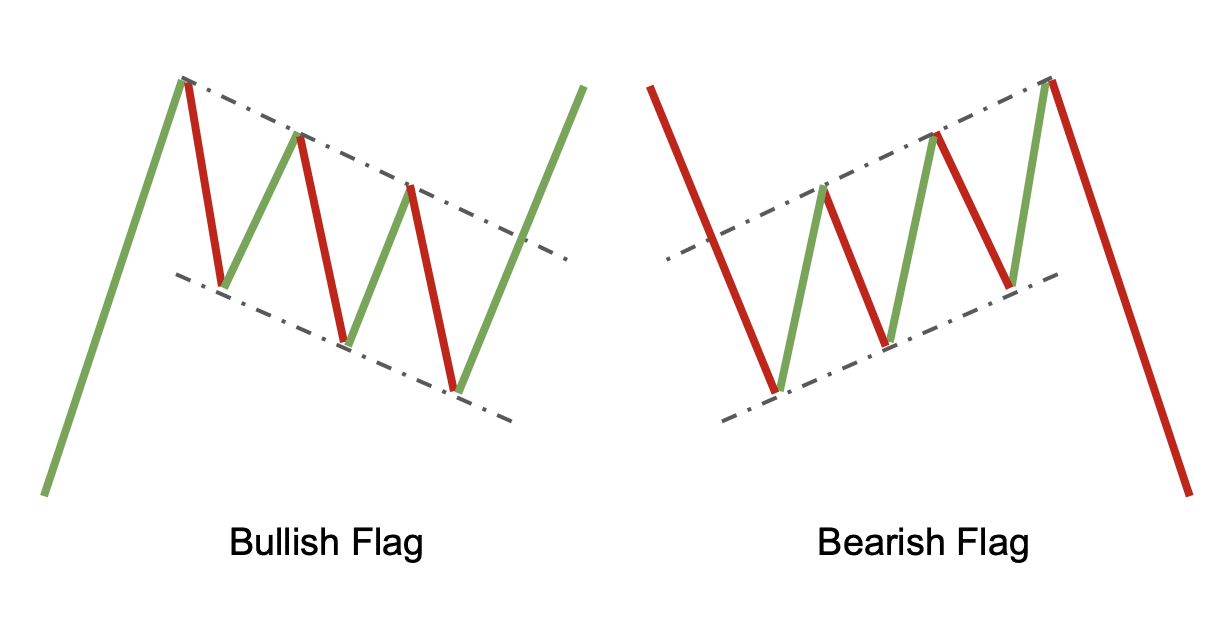

- Flags and Pennants. These bullish patterns typically are formed after a sharp price move occurs, where the price consolidates in a narrow range. Flag patterns have a rectangular shape, while on the other hand, pennants are more triangular in shape. These continuation chart patterns are usually viewed as signs of a continuing uptrend, indicating that the period of consolidation is a temporary stabilization before the trend resumes.

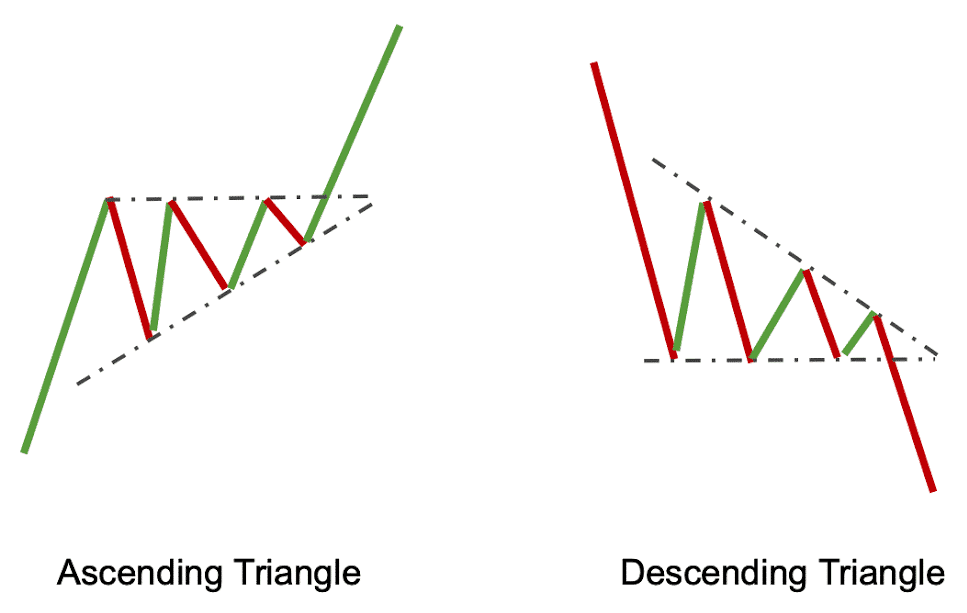

- Ascending and Descending Triangles. These patterns form when the price is moving in a range with a series of higher lows or lower highs. An ascending triangle has a flat top and an upward-sloping bottom trendline, whereas a descending triangle has a flat bottom and a downward-sloping top trendline. These bullish chart patterns are generally regarded as signs of further upward price trends.

Reversal

Reversal patterns can be employed to identify potential direction changes in market trends. Reversal patterns usually occur when a trend is ending; they can signal a shift in the asset’s price. Some examples of reversal patterns are:

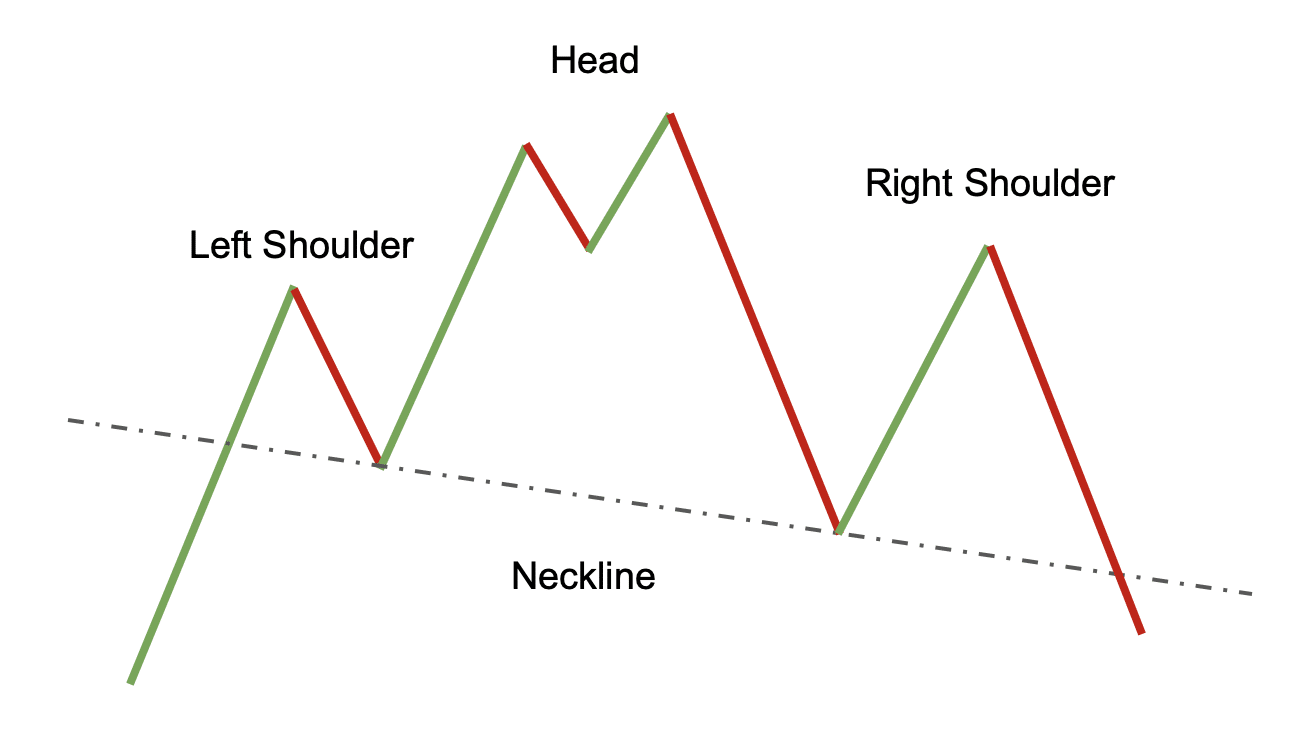

- Head and Shoulders. This is a triple peak pattern that is observed when the price reaches a peak, is then exceeded by a higher peak, and then falls back to a lower peak. It is shaped like a head with two shoulders. This pattern is classified as a bearish reversal pattern.

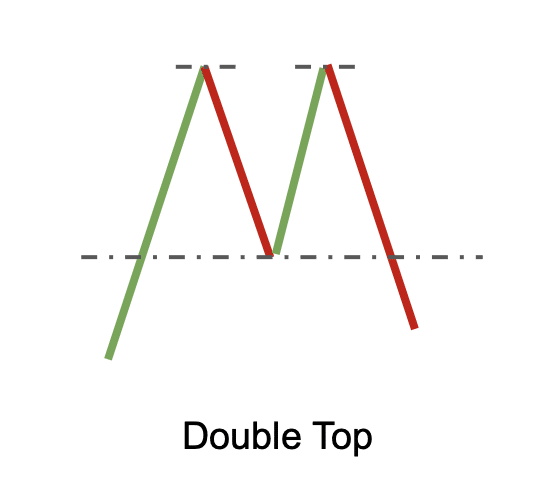

- Double Top/Bottom. This pattern forms when the price reaches a high, pulls back, and then rises to a similar high or falls to a similar low. If this pattern appears at the end of an uptrend, it is referred to as a bearish reversal. If it appears at the end of a downtrend, it is known as a bullish reversal.

Become the smartest crypto enthusiast in the room

Get the top 50 crypto definitions you need to know in the industry for free

How Do You Use a Chart Pattern Cheat Sheet?

Cheat sheets can help traders of all levels, from beginners who are just learning their first chart patterns to experienced traders who are looking for an accessible reference guide. Cheat sheets can help traders save time and make better trading decisions, even if they have identified just a neutral pattern.

Here are some tips on how you can use a chart patterns cheat sheet.

- Understand the Basics. Before incorporating a chart patterns cheat sheet, it is essential to know at least some fundamentals of technical analysis, like what the basic characteristics of price charts are and how to identify support and resistance levels and plot trend lines.

- Identify the Pattern on a Chart. You can either use the chart patterns cheat sheet to identify what is going on in the chart at any moment or choose a few trading patterns you want to follow and look for them specifically. Either way, use the cheat sheet to help yourself identify trend direction easily.

- Confirm the Pattern. To verify that a potential chart pattern is valid, analyze additional technical indicators such as moving averages, the relative strength index (RSI), and volume indicators.

- Recognize Potential Entry or Exit Points. To make the most out of chart patterns, you will need to learn when you should actually execute your trades. For example, when identifying a bullish flag continuation pattern, the best moment to open your long position would be the point where the price breaks above the upper horizontal trendline. For a bearish reversal chart pattern like the evening star, the entry point will be different: typically, it will be near the closing price of the third candle.

- Execute the Trade. After verifying the chart pattern, you can proceed to execute your trade following your general strategy. Establish stop loss and target profit levels, and don’t forget to closely monitor the trade.

Combining a chart pattern cheat sheet with other technical analysis tools and a trading plan can help improve your trading outcomes.

Tips On How To Effectively Use a Free Chart Patterns Cheat Sheet

Focus on High-Reliability Patterns

Concentrate on chart patterns known for their reliability:

- Head and Shoulders: This pattern indicates a potential trend reversal from bullish to bearish. It’s characterized by three peaks: a higher middle peak (the head) flanked by two lower peaks (the shoulders). An 83% success rate makes it one of the most reliable patterns.

- Double Top and Double Bottom: These patterns signal trend reversals. A double top suggests a shift from bullish to bearish, while a double bottom indicates a move from bearish to bullish. Both formations are relatively easy to identify and commonly used in technical analysis.

- Triangles (Ascending, Descending, Symmetrical): Triangles are continuation patterns that suggest the current trend will persist. They form as the price consolidates, creating converging trendlines. The breakout direction often indicates the trend’s continuation.

Confirm Patterns with Volume Analysis

Volume plays a crucial role in validating chart patterns. For instance, a head and shoulders pattern accompanied by decreasing volume during the formation and increasing volume during the breakout strengthens the signal.

Set Entry and Exit Points

Determine precise entry and exit points based on the identified patterns:

- Entry. Enter a trade when the price breaks out of the pattern’s boundary (e.g., neckline in head and shoulders, support/resistance in double tops/bottoms) with significant volume.

- Exit. Determine exit points based on the pattern’s projected price movement. For example, in a head and shoulders pattern, the expected price drop is approximately the distance from the head’s peak to the neckline.

Can Chart Patterns Cheat Sheets Replace Technical Analysis?

No, not even for absolute beginners. Chart patterns (and, by extension, their cheat sheets) are just one aspect of technical analysis, which is a broader discipline that encompasses a wide range of techniques and tools used to analyze market data and identify trading opportunities.

Chart patterns can help gain insights into price movement and market behavior; however they can and should be used in combination with other technical analysis elements, including trend lines, support levels, resistance levels, moving averages, and momentum indicators, to make an informed trading decision.

Chart patterns are not necessarily reliable indicators, as they sometimes lead to incorrect signals or a failure to anticipate market movements correctly. Using chart patterns in tandem with other technical analysis tools and applying risk management principles, such as setting stop-loss orders, can help guide trading decisions. It is also important to manage position sizes and monitor market conditions.

Chart Patterns Cheat Sheets and Crypto Trading

Technical analysis chart patterns can be a helpful tool when observing the volatility and rapid price movements commonly found in cryptocurrency markets. Traders and investors can use chart patterns to analyze the price movements of cryptocurrencies and identify potential trading opportunities.

Nonetheless, it is worth remembering that market conditions and market behavior present in cryptocurrencies do not always mirror those of traditional industries, so chart patterns may not be as reliable. When trading crypto, it is paramount to pay attention not only to various technical indicators but also to the state of the market as a whole.

It is important to be aware of the characteristics of each cryptocurrency and its trading environment prior to using technical analysis principles, as certain chart patterns may occur more frequently in some cryptocurrencies than others. Additionally, you should be aware of different markets — is it currently a bull or a bear market?

Crypto trading requires caution, and technical analysis should be considered as only one element in a wide-ranging trading plan. That said, chart patterns can be useful for spotting potential opportunities.

FAQ

Are chart patterns reliable?

Chart patterns are a tool used in technical analysis that helps to predict future market movements based on historical trends. Their reliability can vary significantly depending on factors like market conditions, time frames, and the specific asset being traded. Furthermore, the result you get from trading chart patterns will also depend on your own skills as a trader.

While crypto chart patterns can be a useful part of trading strategies, it’s important for traders, especially beginners, to understand that they are not foolproof and should be used in conjunction with other methods like fundamental analysis and market sentiment analysis.

Where can I find a chart pattern cheat sheet PDF free download?

You can download a free chart patterns cheat sheet here.

Our comprehensive guide includes various trading patterns, such as the bullish reversal pattern, which signals a potential shift from a downtrend to an uptrend. Understanding these patterns can make your trading journey easier.

Why do you need a chart pattern cheat sheet?

A chart pattern cheat sheet is a valuable resource for both experienced and beginner traders as it provides a quick reference to various technical patterns used in chart analysis.

A typical trading pattern cheat sheet usually includes basic chart patterns, bearish and bullish trends, continuation patterns, and bilateral chart patterns. It can help in identifying potential breakout points, understanding common patterns across different time frames, and refining trading strategies. Having all the chart patterns summarized in one place also helps in making quick informed decisions.

What is the most profitable chart pattern?

Determining the most profitable chart pattern can be subjective, as it often depends on the trader’s individual strategy and market conditions. However, some traders consider patterns like the head and shoulders and double top/bottom as highly reliable for predicting potential reversals. Continuation patterns, such as flags and pennants, can also be just as useful as bullish and bearish chart patterns.

An easy way to find profitable chart patterns is to download a PDF or image file that contains an overview of the most common chart trading patterns.

What is a Forex chart patterns cheat sheet?

A Forex chart patterns cheat sheet is a compilation of common patterns used specifically in the Forex (foreign exchange) market. This cheat sheet usually encompasses a variety of technical patterns, including basic, continuation, bilateral, and bullish and bearish chart patterns. It’s designed to help traders quickly identify and react to potential trading opportunities in the Forex market.

This tool is particularly useful because the Forex market is known for high liquidity and volatility, requiring traders to be adept at recognizing and responding to patterns in real time.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

Leave a Reply